While many forecourt retailers fuss over the high prices of sites in the UK thwarting growth, Blackburn-based Euro Garages continued its march into Europe with the acquisition of ExxonMobil’s retail assets in Germany last month. In one fell swoop Euro Garages which operates under its parent, EG Group Ltd, as far as its European operations is concerned added a further 1,000 sites to its ever-expanding network, which now stands close to an eye-watering 3,500 sites across Europe, employing a staggering 12,500 people.

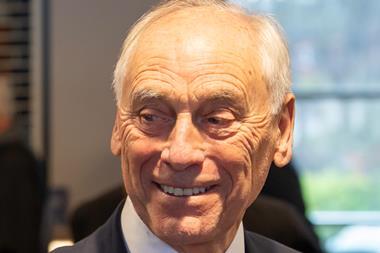

"The UK market has seen a phenomenal level of interest in acquiring forecourt retail assets. Independent operators have realised significant value for their assets as some have wanted to exit. Now it’s hard to get sites in the UK at a reasonable price," says Zuber Issa, co-founder and co ceo of EG Group. "A lot of people are paying premium prices for sites and good luck to those who are able to achieve those premium prices. But is it going to last forever? At the moment we’re investing our money in Europe. Our network beyond the UK covers France, Italy, Belgium, Holland, Luxembourg, the Netherlands, and Germany; and the acquisitions are continuing."

He then reflects back to 2001 when he set the company up with his brother co-founder and co ceo Mohsin with the purchase of a single site in Bury, Greater Manchester: "When we named it Euro Garages, was it by chance or a vision of the future?

"Our aspiration was to own and operate a single site, that became three, then five and at the time we would have been happy to own and operate at least 10. Europe certainly wasn’t on the horizon!"

The company’s history is well-documented as the brothers began to emerge as leaders in their field in terms of site standards and operation, through their passion for quality, convenience and customer service. They won the Forecourt Trader of the Year awards twice with outstanding formats which became a template for the industry, with their new-build modern forecourts, convenience stores and range of branded offers. They set great store in their brand partnerships which include brands like Starbucks, Subway, Burger King, Greggs, KFC, Spar; as well as Shell, Esso and BP on the forecourt.

The expansion of the Euro Garages estate sped up considerably as it took advantage of oil company sell-offs most recently Esso and Shell. In 2016 came the £1.3bn investment deal with TDR Capital, quickly followed by the merger with the European Forecourt Retail Group and its dealings across the Channel.

The UK network for EG Group now stands at around 350 sites, and Zuber confirms that the company has never sold any of its sites: "We have bought well over the years. Our model works for every single site. We can use the strengths of the retail brands to adapt to each individual site."

But in terms of learnings from Europe, Zuber says it’s the other way around: "The UK is advanced in terms of convenience and food-to-go. Europe is still catching up, and it’s going to take time that is where the significant market opportunity is."

For the EG management team, the learning curve is more about recognising the nuances of each market, according to llyas Munshi, the company’s group commercial director: "The French, for example, like espressos more, they prefer a three-course meal for lunch. You have to take all these things on board as you go into each market. Our advantage is that we already have a portfolio of brands that work with us in the UK, and some might work in European markets too. We also have to find local brands to work with. We have to underpin our delivery on our core values and understand the consumer and market trends."

Another aspect of acquiring networks in Europe is gaining expertise in running different types of operations. Direct management has been the foundation of EG Group’s format in all its UK sites. "It’s about control and cohesiveness of site operations," explains Ilyas. "But in European markets we’re having to learn how to implement our model into a co-owned dealer-operated format." Despite all the extra workload and travel required to develop the European business, there is also a great deal of activity taking place in the UK. Apart from ongoing network development, plans have just been approved to build a new HQ in Blackburn, which will serve as a European hub. The existing HQ will be turned into a corporate training and meeting facility. "When you’ve got a company that’s growing at the rate we are, it creates an environment of opportunity and personal development for our people," says Ilyas. "How we train and develop people is going to be critical, and I believe our sector needs to have a more professional approach about career development." Elsewhere the Sainsbury’s trial on nine sites is going very well, says Zuber. "If both parties deem the trial successful, we’ll do a wider rollout." Other EG projects include a £6m spend on reducing its carbon footprint; gaining increased customer insight; and investment in e-charging.

"There’s going to be change on the forecourt and we’ve all got to start looking at it," stresses Zuber. "You need to be seen to be adding value to the consumer offer. If you don’t move with the times, the trends and the consumer, your days are numbered."

And despite their incredible success, the journey for Zuber and Mohsin continues: "When you enjoy what you do, it’s not about the success that comes with a business like ours, it’s also about the thrill of doing it," explains Zuber. "This is a lovely industry, we still enjoy it even more than we did before."

No comments yet