The underperformance of electric-car sales against UK government targets will see car manufacturers issued projected fines of £1.2 billion this year.

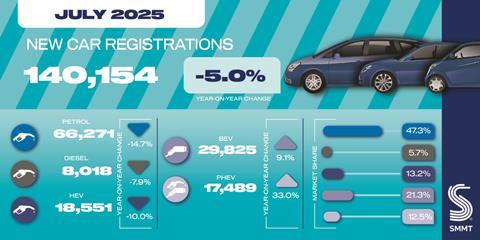

July’s registration figures show 21.3% of the 140,154 cars sold in the UK were electric, but with targets for the year being 28%, consumer wariness around battery power could see car makers hit with record penalties.

The Society for Motor Manufacturers and Traders, which compiled the figures, expects a total of 1.9 million cars to be sold in 2025, and projects that 23.8% of those will be pure electric vehicles.

That equates to a 4.2% shortfall against the year’s 28% EV mandate, meaning 79,800 fewer electric cars will be sold than required. With fines of £15,000 per non-EV sold over quota, that will result in the UK government issuing combined penalties of £1.197bn to car makers.

It’s not all doom and gloom, though: manufacturers can engage in horse trading to help reduce financial liabilities, buying ‘credits’ from firms who exceed the 28% EV mandate. This is likely to result in European firms who still rely on petrol and diesel models for the vast majority of their sales paying significant sums to Chinese car companies who only sell electric models.

Similarly, the recently announced consumer-focussed Electric Car Grant that uses taxpayer funds to knock up to £3,750 off the price of a new electric car could boost sales and see the SMMT’s projected 23.8% EV ratio for the year exceeded - although corporate buyers receive far larger discounts. The government has also been slow to list grant-qualifying cars, with no vehicles yet eligible for the full £3,750, and just four cars, all Citroens, qualifying for the £1,500 discount.

With so much focus on electric it may seem that petrol cars are overlooked, but this isn’t the case with actual customers, who chose a conventional petrol-engined car 47.3% of the time last month. Hybrids and plug-in hybrids took a combined 25.7% of the market, while diesel now exists as a niche choice for new cars, with just 5.7% of sales. All those proportions were down slightly on July 2024 aside from plug-in hybrids, sales of which rose slightly year-on-year.