Close menu

- Home

- News

- Reports

- Fuel

- Retail

-

Shop

- Back to parent navigation item

- Shop

- Shop Suppliers

- Alcohol

- Batteries

- Breakfast

- Car Care & Lubricants

- Chilled & fresh

- Confectionery

- Food to go

- Health & Beauty

- Hot Beverages

- Ice cream & frozen

- Mint & Gum

- Sandwiches & Snacks

- Seasonal

- Soft drinks

- Tobacco & Vaping

- Focus On Features

- A to Z of all Subjects

- Equipment

- Events

- Vision

- Newsletters

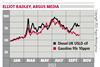

PIPELINE: A tale of two fuels

By Robert Harvey Deputy Editor – Argus European Products 2022-09-26T14:05:00

Gasoline prices in the European wholesale market have collapsed in recent months relative to crude futures, but diesel margins remain unprecedentedly high, creating a dilemma for refiners heading into winter.

Already registered? Please log-in here

To continue reading, register for free today

With free guest access you can:

- Read unlimited articles

- Access the Fuel Market Review

- Read the latest Top 50 Indies report

- Sign-up for our newsletter

- Related Websites:

- Forecourt Trader Awards

- Grocery Retail News

- Convenience Store

- Industry Links:

- Petrol Retailers' Association

- Fuels Industry UK

- Lumina

Site powered by Webvision Cloud