Stable inflation and interest rates, and lower borrowing costs made it easier to buy and sell forecourts in the first half of the year.

That is according to commercial property agency Christie & Co, which says it brought twice the number of properties to the market during this period compared with 2023, and that sales are being fuelled by interest from former commission operators, often welcomed by lenders because of their experience in the industry.

And while bigger businesses are focused on larger sites with potential for several uses, the wider pool of buyers, including smaller multiple operators and first-time buyers, have an appetite for assets at all levels of the market, says the agency in its Retail & Leisure Mid-Year Insight 2024 report.

Christie & Co says that despite macro-economic uncertainty, forecourt operators have maintained gross fuel margins over the past six months, which has mitigated increased overheads.

“We expect this to be broadly sustained in the short to medium term,” says the report.

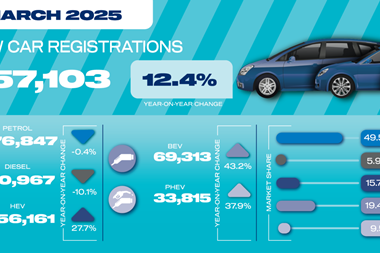

Additionally, it adds, the latest industry figures indicate the uptake of battery electric vehicles (BEVs) continues to “flatline”, so that previous projected reductions in fuel volumes have been revised. This has “improved market sentiment and helped to drive demand”.

Steve Rodell, managing director – Retail & Leisure said: “We have successfully navigated through some uncertain macro-economic waters in the last two years.

”We took some bold steps to expand our markets and it is very encouraging how the markets have received our involvement.”