Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders, gives his most candid interview yet on electric vehicles.

You’ve got to hand it to Mike Hawes: not many chief execs would leave the stage after a data-rich, politically astute speech to representatives of most of the UK’s automotive sector, then happily conduct, completely unadorned by PR handlers, a 10-minute on-the-record interview on a contentious subject.

We’re talking, unsurprisingly, about electric cars, the only topic in town, and I open by asking if given the government has pivoted significantly on a number of areas of late, he thinks it possible that a U-turn on EV policy is on the cards.

“I don’t think that will happen”, he says of any major change to the mandate. “And I don’t think the industry wants that to happen – they’ve invested in this technology. You need to get a return on that investment, and that return is never going to be one year or two years.”

While he is firm that “at the moment there are no further plans” for changes to the mandate, he agrees that “we need to keep a very close eye on it”, conceding that “the policy is only good if it’s able to be achieved. If you can’t achieve it, then you’ve got to look again”.

He also recognises the significance of the challenge electric cars present, and the scale of the changes policy seeks to make to people’s lives.

“I’m a political realist - I know where we are”, he says. “Invariably, when you’re looking at such a fundamental transition, and I’m not just talking about vehicles – about decarbonisation, net zero – there are costs. And when costs are hitting consumers, that’s when the pressure is the greatest on that transition.”

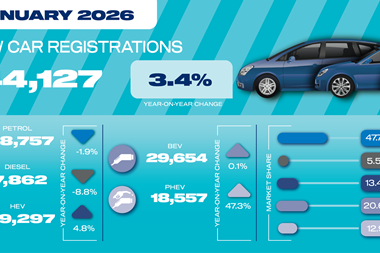

He acknowledges that the assumptions behind mandating electric cars “were made a number of years ago, when the circumstances were very different”; that there is a fair degree of scepticism surrounding EVs; and that the private market, which bought only 10% of EVs last year, is indicative of natural demand – though he says that figure “feels a bit higher this year”.

While the establishment and industry’s overall position on electric cars remains unchanged, Hawes calls the £4.5bn car makers put into EVs last year via discounting (presumably selling vehicles or finance deals at loss) “unsustainable”. This cost, don’t forget, is in addition to the revenue the Treasury gives up from all the corporate EV drivers who don’t pay full company-car taxes.

A lot of cash has been thrown at electric cars from businesses, government and, ultimately, people, in other words, but Hawes thinks more needs to be done. “We still believe there is a strong case for private retail incentives from the government”, he says.

Turning to electric trucks, Hawes emphasises that while some firms, particularly in Germany, believe that “technological evolution” will solve some of the shortcomings of these vehicles, he considers that “there are more technological solutions other than electrification” for haulage, adding: “I totally accept that the battery pack you’re having to carry to get a reasonable range has to compromise your payload.” Interestingly, in his on-stage speech earlier, Hawes referred the 2035/40 ban on non-zero-emission HGV cabs as a “notional” date.

Utterances like this indicate that narratives on electrification are neither static nor divorced from reality, a sentiment Hawes emphasises is present in Whitehall.

“Politically I think they’re being quite pragmatic. You’ve seen Heathrow, the additional runway, and additional capacity at Gatwick by opening up a second runway; to a certain extent the additional flexibility around the [ZEV] mandate – all of these come at a carbon cost.”

That additional flexibility concerns the recent (re)confirmation that new conventional and plug-in hybrids can stay on sale until 2035, and it’s not just the UK that is considering these matters closely. Our continental neighbours are also asking questions around how petrol and diesel cars are phased out.

“One of the things I think we should be looking at is a more fundamental review of this transition, because you’re seeing potential changes in Europe, we’re seeing the market not moving as quickly as we want it to.”

Another interesting detail to emerge over the course of our conversation is that the while UK EV registrations were up last year and numbered almost 400,000, this was not necessarily indicative of big changes in market mood. “A large proportion of those EV sales were substitutions – people moving out of an old EV into a new EV – they weren’t conquests from ICE [internal combustion engine drivers]”.

Despite the short amount of time between now and 2030, when new pure-ICE cars are for the chop, clearly pieces are still being moved around the chessboard. Because while government and industry remain convinced of their thinking on private transport, drivers (and voters) seem to have other ideas. Who blinks first? Place your bets now.