If your wet-stock contract is up for renewal, now is a great opportunity to improve your margins by optimising your systems. So says Morten Raaby, general manager Europe at Titan Cloud.

“Fuel analytics is changing the game for fuel retailers ready to move beyond just compliance. Using data, you already have, your system can also inform business decisions that reduce fuel loss and recapture revenue,” he says.

Raaby explains that wet-stock management technology has understandably focused on environmental compliance to navigate the evolving regulatory landscape. But he asks what about other competing priorities wet-stock managers juggle on any given day?

“Systems efficiency, optimised inventory processes and the minute-to-minute anomalies that pop up regularly are also critical to business operations. Traditional technology based solely on environmental compliance monitoring doesn’t address the disruptions and systemic inefficiencies that can cripple an operator’s supply chain.”

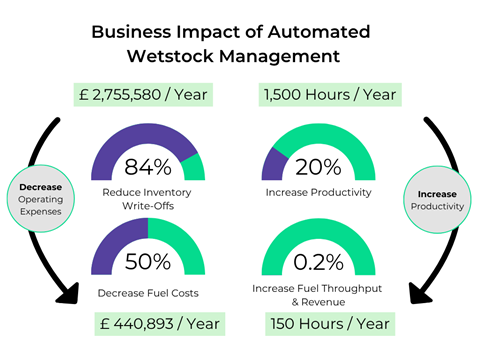

He says that if these things are left unchecked; they lead to a steady erosion of profits. “Titan Cloud’s data has shown that roughly 20-30% of total fuel supply chain costs are avoidable, stemming from inefficiencies like excessive stock, poor asset utilisation and a lack of end-to-end visibility.

“Without transparency and a holistic view of inter-reliant systems, outdated technology is severely limited, keeping fragmented systems siloed and tracking parts of the downstream fuel supply chain while not communicating with others. From maintenance costs and equipment expenses to testing and staffing, these disparate systems can create a significant financial burden for wet-stock managers.”

One way fuel operators can make quick and significant improvements to their downstream fuel management is with data they already have within Statistical Inventory Reconciliation (SIR) systems.

“In many countries, SIR is either required by law or widely advocated as best practice. As such, it’s often treated as simply an obligatory box to tick. The reality is quite different and presents a real opportunity to streamline nearly every component of site management, from inventory to maintenance.

“Think about it. SIR uses data analysis to generate a pass, fail or inconclusive results report. That data is being pulled from combined systems like ATGs, manual dipping methods, POS and BOS systems, and delivery dockets – all to check for leaks or other anomalies impacting compliance status. But that data tells other stories as well. The sophisticated algorithms used by SIR are also analysing fuel inventory, delivery information and dispensing data that can uncover nearly every action making up a retailer’s downstream fuel operations.

“By turning raw data into operational intelligence, SIR can pinpoint the cause of discrepancies to reveal where actual issues are developing – and the root cause of problems.”

Raaby says wet-stock managers can then prioritise service calls based on urgency, provide technicians with the best information possible to target remediation and stop overspending on maintenance. “Put simply, SIR empowers operators to shift from reactive issue management to proactive, performance-driven decision-making.”

It’s not secondary containment

Edward Wheeler, group managing director of Eurotank, has strong views on SIR. “It’s not secondary containment,” he says. “This is an important message that I try to repeat to customers so they aren’t complacent about the risk of underground fuel system leaks.”

Wheeler says SIR is a critical control measure for monitoring your fuel stocks for signs of leaks underground but adds: “Underground fuel systems carry more risk because you cannot inspect them with your eyes for leaks like you can with above-ground systems. SIR is very good at smoothing out errors in wet-stock data over time. Measuring fuel with calibrated dipsticks was actually a very accurate way of managing fuel tank stocks but was not continuous so leaks could occur between ‘dipping’ of the tanks and nobody would know.”

He explains that automatic tank gauges were introduced to provide continuous monitoring, but calibration of these gauges was far from perfect. “Strapping tables provide the liquid volume-to-height data, but these don’t exist for most underground tanks so ‘best guess’ is probably the most accurate way of describing the strapping table data held within tank gauges. What this means is that inaccuracies in the tank gauge strapping tables generally cause losses and gains every day, which are not real. SIR uses statistical algorithms to unpick these daily losses and gains over time, usually seven days, to determine if the losses or gains are real or not.”

Wheeler says there are certain blind spots that retailers need to be aware of. “The main one is losses on fuel deliveries. If an underground fill pipe that takes fuel from the tanker to the tanks, develops a small leak, let’s say for example, a drip of one litre into the ground every time there is a delivery, SIR will not detect this as a problem. This is the main reason why oil companies now specify monitored double-wall fill pipework as they are aware of the risk. Double-wall pipework is secondary containment.

“Another blind spot is vapour loss. SIR is measuring liquid fuel and not vapour, so if there is an underground leak of vapour somewhere in the fuel system, it is unlikely to be detected by SIR.”

He reiterates the point that having SIR in place is a critical control measure that everyone who operates an underground fuel system should have in place so losses can be identified, but only underground fuel systems with monitored secondary containment in place for all liquid- and vapour-carrying parts of the system can be 100% sure they are not leaking fuel or vapour into the ground.

“Big leaks to ground are few and far between but they do happen and all the big leaks I can think of in the past 20 years have been on sites that did have SIR monitoring in place.

“Retailers should take some comfort if they have SIR monitoring on their sites but also appreciate its limitations and don’t confuse it as secondary containment. All it is going to tell you is how much you’ve lost.”

Eurotank can provide SIR as well as secondary containment solutions. Its SIR partner is FuelPrime, a Polish company, which Eurotank became a distributor and installer for last year.

Quality input

Back to Titan Cloud, and Raaby warns that data analysis is only valuable when it’s based on quality input. “Inaccurate systems data is a common revenue thief for wet stock managers,” he explains.

“Recently, Titan Cloud worked with a large retail fuel operator who needed to more accurately diagnose fuel loss factors across multiple sites. Specifically, the retailer needed to eliminate incorrect fuel loss data by enabling site operators to quickly differentiate between leaks, theft and calibration problems.

“Tank gauge calibration was especially problematic, as their outdated systems were manually processing raw data, leading to errors. Incorrect data was then fed into calculations, prompting frequent false investigations and costing the company time and money.”

Using Titan Cloud’s wet-stock management solution, the fuel retailer was able to access accurate variance data, identify fuel loss factors quickly and target investigations accurately; all of which saved inventory, countless labour hours and revenue. Raaba says centralising their data analytics into a unified hub also enabled remote troubleshooting so operators could diagnose inventory issues without spending excess time on the forecourt. “This was particularly beneficial as many of their sites were in remote parts of the country.”

He understands that the sheer volume of data generated at retail fuel sites can feel overwhelming, but says specialised technology designed to organise that data into actionable insights presents a tremendous opportunity. “Smarter solutions built on AI-driven automation can unlock the potential to completely transform and improve business operations.”

Raaby says the Titan Cloud team works side-by-side with customers to make sure the solution addresses their specific needs. “For many, our integrations are timed to replace contracts that are wrapping up or traditional technologies moving toward sunsetting. If this is the case for your business, now is the time to look forward with an eye on end-to-end optimisation.”