Key markets in the EV transition are falling behind in their stated goals for public charging infrastructure, according to latest figures.

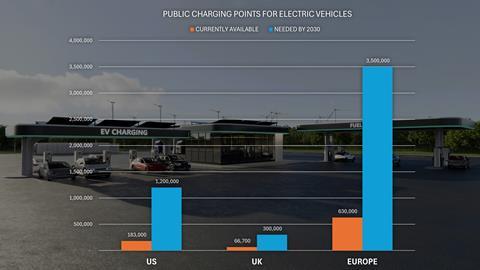

Data reveals that the US, Europe and the UK are more than six times behind the number of plugs needed to meet growing EV demand by 2030. The US, the world’s second-largest EV market, has under 200,000 publicly available charging ports, with over one million more needed by 2030, according to McKinsey, representing a 550% increase. Europe needs a 5.5-fold increase to the 630,000 public chargepoints currently available across the continent to meet European Commission 2030 targets, according to the European Automobile Manufacturers Association. And the UK requires a near 350% increase to scale its chargepoints from just under 70,000 to 300,000 by the end of the decade, according to the National Infrastructure Commission.

This deficit in EV charging points represents a considerable opportunity for fuel retailers. Konect, an innovator in EV charging established by Gilbarco Veeder-Root (GVR), believes that existing fuel retailers are in a prime position to plug the gap, thanks to their optimum blend of location and amenities.

Om Shankar, vice president and general manager, Konect, says: “At current installation rates, key global EV markets won’t meet the public charging infrastructure needed to meet growing EV demand. We know that most EV drivers currently plug in at home, but there’s a second cohort of buyers, beyond the early adopters, that don’t have the same facilities.

“As EV technology improves, costs go down and range goes up – more people will make the switch. We must match this progress with the right amount of readily available public charging. We need some logical thinking on the placement of new chargepoints – ideally, locations that are already familiar and convenient for car drivers. That’s the golden opportunity for the existing fuel retail network.”

However, the industry needs to remove key blockers to effective service in order for fuel retailers to build a business case for reliable and profitable EV charging. In a survey of multiple chargepoint operators, Konect discovered that over 71% find recording chargepoint downtime at their sites challenging, with well over half (57%) identifying support from service partners as the biggest blocker to improved uptime.

“We know that providing an easy and reliable public charging experience is critical to the EV transition. Konect has the technology and expertise to support fuel retailers and CPOs through the electrification transition by delivering reliable, user-friendly infrastructure for drivers, while boosting ROI and enhancing time to value,” Shankar adds.