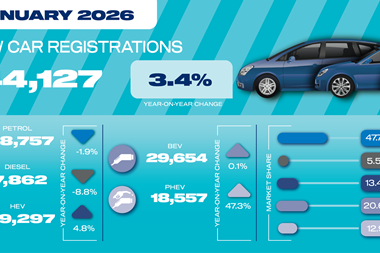

The UK new-car market grew by 1.6% in May, with 150,070 vehicles registered, up from 147,678 in May 2024 – though registrations to private individuals were down 2.3%

The sector remains 18.3% down on pre-pandemic 2019, and May saw just the second month of growth this year.

The Society of Motor Manufacturers and Traders, which compiles registration data, says the “significant discounting” applied to electric vehicles by manufacturers is “unsustainable”.

In addition to manufacturer discounts, fleet and corporate buyers, which provide company cars and vehicles offered to employees via salary sacrifice schemes, receive significant tax incentives from government. Fleet and business buyers drove May’s modest growth, with registrations up 3.7% and 14.4% respectively.

Private buyers, who are unincentivised to buy electric cars, and choose petrol, diesel or hybrid roughly 90% of the time, registered 56,131 vehicles in May, 1,322 fewer than the same period last year.

As a whole, 5.2% of the cars registered last month were diesel, 47.5% were petrol, 25.5% were hybrids, and 21.8% were pure electric – significantly behind the 28% proportion of new cars that must be battery powered this year, on pain of manufacturers receiving government fines of £15,000 per vehicle over quota – though firms can pay for ‘credits’ from companies that only or predominantly sell EVs, so beat the 28% target by default.

Commenting on the data, The SMMT’s chief executive, Mike Hawes, said that “manufacturer discounting on new products continues to underpin the market, notably for electric vehicles”. Warning that “this cannot be sustained indefinitely”, Hawes said the government should use the upcoming Spending Review to implement “fiscal measures that boost the market and shore up our competitiveness”.