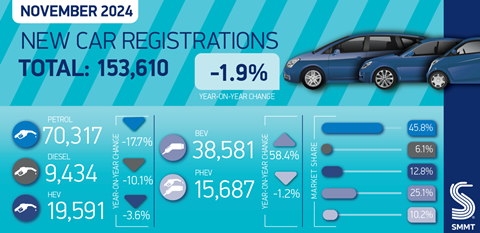

Battery electric vehicle (BEV) registrations rose for the 11th successive month in November, up 58.4% to 38,581 units, representing 25.1% of the overall market but driven by heavy manufacturer discounting.

According to the latest figures from the Society of Motor Manufacturers and Traders (SMMT), this was the best market share since December 2022, with November just the second month this year in which BEV uptake has reached mandated levels, albeit against the backdrop of a declining overall market.

The SMMT says this year’s growth cements Britain as Europe’s second biggest new BEV market by volume and it is closing the gap on leader Germany. It reflects long-term manufacturer investment in new models, with more than 130 zero emission choices now available – up more than 42% on a year ago – on which the sector is offering record discounts. However, while this is providing some success, the Society says the scale of discounting, worth some £4bn across 2024, is unsustainable and poses a risk to future consumer choice and UK economic growth. “With the right, responsive market regulation, however, the UK could hold a commanding position as an exemplar global market for a rapid zero emission transition,” it says.

According to the latest industry outlook, BEV registrations will need to grow by an additional 53% in 2025 if next year’s 28% mandated target is to be met – equivalent to 90,000 more businesses and consumers making the switch than the industry outlook expects.

Mike Hawes, SMMT chief executive, says: “Manufacturers are investing at unprecedented levels to bring new zero emission models to market and spending billions on compelling offers. Such incentives are unsustainable – industry cannot deliver the UK’s world-leading ambitions alone. It is right, therefore, that government urgently reviews the market regulation and the support necessary to drive it, given EV registrations need to rise by over a half next year. Ambitious regulation, a bold plan for incentives and accelerated infrastructure rollout are essential for success, else UK jobs, investment and decarbonisation will be at further risk.”

Overall figures show that deliveries of new cars fell by -1.9% in the UK during November with 153,610 joining the road. It is the second consecutive monthly decline, and the third decline in four months.

November saw double-digit falls in registrations of petrol (-17.7%) and diesel (-10.1%) cars, but petrol remained the most popular powertrain. Hybrid and plug-in hybrid uptake also declined, by -3.6% and -1.2% respectively.