Close menu

- Home

- News

- Reports

- Fuel

- Retail

-

Shop

- Back to parent navigation item

- Shop

- Shop Suppliers

- Alcohol

- Batteries

- Breakfast

- Car Care & Lubricants

- Chilled & fresh

- Confectionery

- Food to go

- Health & Beauty

- Hot Beverages

- Ice cream & frozen

- Mint & Gum

- Sandwiches & Snacks

- Seasonal

- Soft drinks

- Tobacco & Vaping

- Focus On Features

- A to Z of all Subjects

- Equipment

- Events

- Vision

- Newsletters

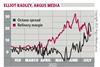

PIPELINE: Margins in focus as retail prices soar

By Elliot Radley, Argus Media 2022-07-18T14:32:00

Spreads between different grades of gasoline have widened sharply in the past month with the value of octane soaring.

Already registered? Please log-in here

To continue reading, register for free today

With free guest access you can:

- Read unlimited articles

- Access the Fuel Market Review

- Read the latest Top 50 Indies report

- Sign-up for our newsletter

- Related Websites:

- Forecourt Trader Awards

- Grocery Retail News

- Convenience Store

- Industry Links:

- Petrol Retailers' Association

- Fuels Industry UK

- Lumina

Site powered by Webvision Cloud