Supermarkets have failed to compete effectively on fuel prices, according to a damning report by the Competition and Markets Authority (CMA).

It found that from 2019-22, average annual supermarket margins increased by 6ppl and that increased margins on diesel across all retailers have cost drivers an extra 13ppl from January 2023 to the end of May 2023

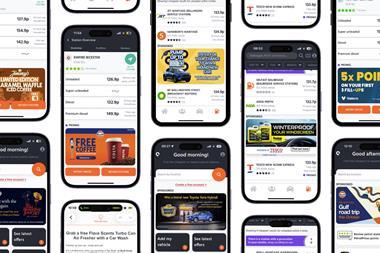

In response it is calling for a new fuel finder scheme to enable drivers access to live, station-by-station fuel prices on their phones or satnavs to help revitalise competition in the retail road fuel market.

The scheme would be made possible by new compulsory open data requirements and backed by a new ‘fuel monitor’ oversight body. The proposals are the CMA’s key recommendations to the UK government following its in-depth study into the road fuel market.

The fuel finder open data scheme would need statutory backing through legislation to ensure fuel retailers provide up-to-date pricing and make that available to drivers in an open and accessible format that can be easily used by third party apps such as satnavs or map apps, through a dedicated fuel finder app, or a combination of both.

The fuel monitor would monitor prices and margins and recommend further action if competition continues to weaken in the market. As the UK transitions to net-zero the demand for petrol and diesel will reduce. The fuel monitor will help us understand the impact of this on vulnerable consumers that remain dependent on petrol and diesel for longer, as well as those living in areas with limited choice of fuel stations.

The report found that supermarkets are generally the cheapest places to buy fuel, with Asda typically the cheapest of those, and this had anchored prices in the past. However, the CMA found that in 2022, Asda and Morrisons each made the decision to target higher margins. Asda’s fuel margin target in 2023 was more than three times what it had been for 2019, while Morrisons doubled its margin target in the same period.

Other retailers, including Sainsbury’s and Tesco, did not respond in the way it would expect in a competitive market, by competing for market share, and instead raised their prices in line with these changes. Taken together, the CMA said, this indicates that competition has weakened and reinforces the need for action.

It also found that diesel prices have been slow to drop in 2023, partially down to Asda ‘feathering’ (reducing pump prices more slowly as wholesale prices fell) its prices and other companies not responding competitively to that. As a result, the CMA estimates that drivers have paid 13ppl more for diesel from January 2023 to the end of May 2023 than if margins had been at their historic average.

Sarah Cardell, chief executive of the CMA, said: “Competition at the pump is not working as well as it should be and something needs to change swiftly to address this. Drivers buying fuel at supermarkets in 2022 have paid around 6ppl more than they would have done otherwise, due to the four major supermarkets increasing their margins. This will have had a greater impact on vulnerable people, particularly those in areas with less choice of fuel stations.

We need to reignite competition among fuel retailers and that means two things. It needs to be easier for drivers to compare up-to-date prices so retailers have to compete harder for their business. This is why we are recommending the UK government legislates for a new fuel finder scheme which would make it compulsory for retailers to make their prices available in real time. This would end the need to drive round and look at the prices displayed on the forecourt and would ideally enable live price data on satnavs and map apps.

“Given the importance of this market to millions of people across the UK this needs to be backed by a new fuel monitor function that will hold the industry to account. As we transition to net zero, the case for ongoing monitoring of this critical market will grow even stronger, so we stand ready to work with the UK government to implement these proposals as quickly as possible.”

The CMA also found the price premium at motorway service stations has grown in real terms since 2012, and price variation on motorways is low, due to limited competition between service stations. It said a fuel finder scheme would allow drivers an easy way to see where they can find cheaper fuel in the area if they come off the motorway.

The CMA has also imposed fines totalling £60,000 on Asda for failing to provide relevant information in a timely manner. Asda received two fines, each of £30,000 (the statutory maximum), for sending a representative to attend a compulsory CMA interview who was not equipped to provide evidence on certain topics the CMA had identified in advance, and failing to respond completely to a compulsory written request for information.

An unnamed Asda shareholder and a senior executive attended a later meeting and provided the CMA with the required information.

Responding to the CMA report RAC fuel spokesman Simon Williams said: “This is a landmark day when it comes to fuel prices in the UK. The fact that drivers appear to have lost out to the tune of nearly £1bn as a result of increased retailer margins on fuel is nothing short of astounding in a cost-of-living crisis and confirms what we’ve been saying for many years that supermarkets haven’t been treating drivers fairly at the pumps.

“It’s all about action now and we very much hope the Government follows through with both of the CMA’s recommendation. While forcing retailers to publish pump prices is a positive step for drivers, what’s of far more significance is the creation of a fuel monitor function within government which, we very much hope, actively monitors wholesale prices to ensure forecourts don’t overcharge when the cost they pay to buy fuel drops. Without this, we fear drivers will continue to get a raw deal.

“Data we shared with the CMA shows there have been several instances of ‘rocket and feather pricing’ when the cost of wholesale petrol and diesel fell but it took an inordinate amount of time for supermarket pump prices to reflect this. And on several occasions, they didn’t ever fully cut pump prices to reflect just how far the wholesale market had dropped. This is even the case today with diesel prices as for more than three months the cost of buying diesel on the wholesale market has been less than petrol, yet it remains the case that drivers are still having to pay more for diesel than unleaded at the pumps. At one point the average margin charged on diesel was 25ppl, which is more than three times the long-term margin of 7ppl. This shouldn’t be allowed to happen, particularly when the Treasury has reduced duty by 5ppl to help households struggling with the cost-of-living crisis.

“Interestingly, Northern Ireland is a good example of a competitive fuel market as retailers more closely reflect movements on the wholesale market. While drivers can research the best price in their area via a useful online fuel checker, the main reason for lower prices is a greater number of forecourts there per driver and the fact that the big four supermarkets don’t have the same hold on fuel retailing as they do on this side of the Irish Sea. The new fuel price monitor should look at price behaviour there to see if there are any lessons to be learned for the rest of the UK.

An Asda spokesperson said: “The CMA’s comprehensive road fuel market review recognised Asda as the price leader and confirmed the presence of an Asda petrol station in a local area keeps prices down for all motorists. Despite record inflation, we have carefully managed our business to ensure Asda was the cheapest traditional supermarket for both groceries and fuel throughout the period reviewed by the CMA and this position is unchanged.

“The penalty notices relate to two individual alleged technical breaches in the way information was shared with the CMA over a 12-month period, during which time a significant number of documents were shared with the CMA to aid their study and we engaged fulsomely with their enquiries. As the price leader in the supermarket fuel sector, we welcome any initiative that makes it easier for motorists to compare fuel prices, such as an app or other technology-based solutions.”