There was a time when some people sniffed at RTDs (ready to drinks) but they’ve come a long way from their cheap and cheerful beginnings.

A recent sign of just how far they have come was Diageo’s launch of its super-premium vodka brand, Cîroc, in an RTD format. Cîroc Summer Citrus and Cîroc Tropical Passion, (both 5% ABV), are both available in 250ml cans, rrp £1.85.

The move is easy to understand given that Nielsen data has Great Britain’s RTD market valued at £540m, which is the largest in Europe. The RTD segment is also the fastest growing within the total alcohol category and premium options have driven this growth by +33% in recent months (Nielsen).

Diageo says its Cîroc launches aim to give retailers an opportunity to tap into the macro trend for affordable indulgence and provide consumers with a sense of luxury when enjoying an RTD format.

Conor Brown, Cîroc brand manager, Diageo GB, says: “Our core Cîroc range has performed well for many years across the off-trade, with our flagship Cîroc Blue Dot vodka variant owning the highest rate of sale across the super-premium vodka category (Nielsen). Cîroc is also well known for flavour innovation, having made our popular limited-edition flavour variants, like Summer Citrus, a permanent fixture of the portfolio due to demand.

“The brand’s move into the RTDs space feels like a natural progression… Particularly as we approach the summer, the new range is ideal for attracting shoppers who are on the go, attending festivals, planning get-togethers with friends such as BBQs and picnics, and looking to elevate those occasions with a more premium option.”

The introduction of Cîroc Summer Citrus and Cîroc Tropical Passion will be supported by a disruptive marketing campaign across social and digital, which aims to make the launch ‘unmissable’ to consumers.

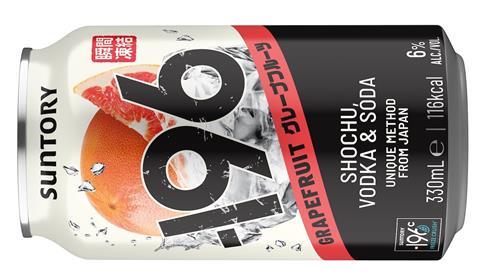

Taste of Japan

Another new RTD launching this month in Great Britain comes from Lucozade and Ribena producer Suntory Beverage & Food Great Britain and Ireland (SBF GB&I).

The company is expanding into the RTD alcohol market with the launch of Japanese RTD brand -196 (minus one-nine-six). The company will launch two flavours : Lemon and Grapefruit, both with 6% alcohol content.

Since its launch by Suntory Holdings in Japan in 2005, -196 has become a well-established canned RTD alcohol brand in the country and continues to grow in popularity. Following successful launches in Australia (2021) and China (2023), this year the brand sees further global expansion to Great Britain, Germany, the US and Southeast Asia.

The -196 brand name is a reference to the use of Suntory’s proprietary freeze crush infusion technology. This process freezes the whole fruit by using liquid nitrogen at -196°C and the frozen zest, pulp and juice are then crushed into powder and infused with vodka.

SBF GB&I says the brand brings something new and different to the RTD alcohol category here, by combining a traditional Japanese spirit with modern technology to deliver an “exciting new taste and experience” for consumers.

Alpesh Mistry, sales director at SBF GB&I says: “It’s our first step into alcohol but with years selling some of the UK’s most popular soft drinks and the continued strong performance of our brands, we know we can make it success. We have a number of people in our business who bring great previous experience of the alcohol market, so know we’re in a strong position to bring this exciting launch to consumers.”

Mega brand link-up

A link-up with another mega brand marked Coca-Cola’s entrance into the RTD market. The Jack Daniel’s and Coca-Cola RTD first debuted in Mexico in November 2022 and made its way to the UK last year.

Nikos Koumettis, president Europe OU, at The Coca-Cola Company, said at the time of the UK launch: “Jack Daniel’s and Coca-Cola RTD was born ready to be a fan-favourite, boldly bringing our flavours together to form this iconic pairing. Both of our brands are inspired by our fans’ endless innovation in mixing the best, to get the best, and we can’t wait for them to give this a try.”

Elaine Maher, associate director at Coca-Cola Europacific Partners, also said at launch: “The UK is the biggest alcoholic RTD market in Europe and is expected to grow significantly by 2030, driven largely by pre-mixed cocktails. Within this, whisky-based variants are in growth…Jack Daniel’s and Cola is already the number one pre-mixed SKU in GB worth £38m RSV(Nielsen) and with consumer testing revealing that shoppers are more likely to pick up the new Coca-Cola co-branded Jack Daniel’s RTD SKU, we’re confident further growth will follow.”

Maher was right and the Jack Daniel’s and Coca-Cola RTD range has generated nearly £21m-worth of sales since it launched in March 2023. There is also a Zero Sugar variant which has generated around 17% of these sales to date(Nielsen). CCEP recently refreshed the packaging design for the Coke Zero version to clearly differentiate it from the Coke Original Taste variant.

![]()

Absolut hit

The Jack Daniel’s link up was just the first Coca-Cola Company foray into RTDs. Last autumn, the company announced a new partnership with Pernod Ricard which resulted in a new Absolut Vodka & Sprite being launched here.

Absolut Vodka & Sprite 250ml cans contain 5% ABV and have an rrp of £2.30.

Francesco Ottaviano, global RTD portfolio director at Pernod Ricard, says: “While Absolut Vodka and Spritehave long been enjoyed together around the world, we now unite two powerhouse brands in a unique RTDproduct. We are thrilled to present this exclusive premium proposition in a convenient and portable format to our European consumers.”

The launch will be supported by a summer marketing campaign which will include PR, social media and influencers, sampling and out-of-home advertising. Forecourt retailers can also visit the CCEP trade websitefor pos kits and digital assets.

Summer sensation

A well-established player in the RTD market is Pimm’s No.1, in a 250ml premix can with lemonade (5.4% ABV), which is currently worth £3m in the off-trade (Nielsen) and sells particularly well during the summer.

Brand owner Diageo says the key motivation for RTDs is convenience, with most RTD occasions taking place at home or in a friend’s home. This means the forecourt channel naturally lends itself as a go-to location for shoppers to purchase RTDs while on their way to a range of summer socialising occasions, including barbecues, picnics, garden parties and nights in.

The company recommends implementing multibuy offers, as well as introducing special Bank Holiday promotions, to encourage shoppers to buy. These should be clearly signposted in-store and amplified across social media.

Hazan Aydın, head of Gordon’s & Pimm’s, Diageo GB, says: “Pimm’s has a long association with British summertime and events. Our iconic Pimm’s No. 1 has been, and will continue to be, a staple for retailers during warmer months.”

Why WKD is a must stock

To maximise the RTD opportunity and ensure shopper interest in fixtures this summer, forecourt retailers should be sure to give due prominence to WKD, the UK’s number one RTD (Nielsen). So says Alison Gray, head of brand at WKD owner SHS Drinks.

“WKD consumers aren’t ones to plan in advance so convenience retailers offer the all-important opportunity to purchase quickly and efficiently,” she says.

“As the number one RTD by volume, WKD is the brand sought out most often for these unplanned purchases. Iconic WKD Blue 700ml remains the long-stand leading SKU in the impulse channel by value and is a must-stock for all retailers looking to maximise RTD sales.”

Gray says forecourt retailers have the added advantage that shoppers can swing past, park for free and pick up a WKD four-pack or 10-pack or a couple of 700ml bottles without concerns about carrying heavy drinks home.

“Those forecourts that can offer chilled product have an added advantage in providing a service not widely available in the grocery multiples. And, for the spontaneous WKD consumer, pre-chilled stock is a real attraction and holds strong appeal.”

She explains that the long-term prospects for the RTD category are good as the key attributes – convenience, versatility, portability, fun – are more important to consumers now than they possibly ever have been. “Couple that with the fact that the category is more diverse than ever now in terms of ABVs and flavours, and it’s fair to say that consumers have more reasons to stay in the category for longer than was the case historically.”