* Energy giant reports record convenience gross margin for fourth quarter running

* Roll-out of electric charging points continuing at a pace

* Annual profits second only to 2022 in 10 years

* BP continuing transition to integrated energy company

BP’s investment in its non-fuel retail offer is paying off according to the energy giant, which reported a record fourth-quarter gross margin - an indicator of the profitability of its convenience outlets.

The company said that the growth across its global convenience operations was “underpinned by customer offers driving stronger margin mix, continued roll-out of strategic convenience sites and strategic convenience partnerships”.

Overall, the UK-headquartered firm reported its second-best annual profit in 10 years for the year to 31 December, although it was half 2022’s figure, when soaring oil prices in the wake of Russia’s invasion of Ukraine drove up returns for all oil companies.

What BP calls its pivot from “international oil company to integrated energy company” has seen it focus heavily on boosting its convenience portfolio and roling out electric vehicle charging points, a trend that continued at pace during 2023.

BP plans to be directing about a half its annual investment into “transition growth engines”, which include convenience, bioenergy, and EV charging.

In February 2023, it acquired TravelCenters of America, one of the USA’s largest roadside operators, a move BP said would complement its existing off-highway-convenience network in the country.

It said it woud use the acquisition to expand and develop “new mobility offers” including EV charging - Americans in general have been slower to switch to electric than their European counterparts, despite market leaders such as Tesla being based there.

In its annual results statement, BP also highights its new joint venture with Iberdrola in Spain and Portugal, formally established on 1 December. Under the pairing, announced in March, the two companies plan to roll out a network of up to 11,000 rapid and ultra-fast public chargepoints in the two countries by the end of the decade.

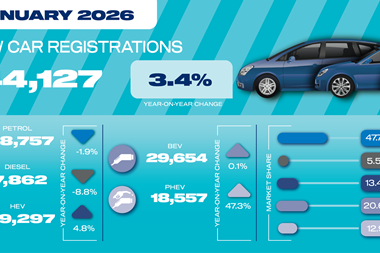

BP says its chargepoint network grew by 35%, and energy sold by 150% during the year. It now has more than 29,000 chargepoints worldwide.

Overall, BP says it is stepping up capital expenditure to around 16 billion dollars a year in 2024 and 2025, up from previous guidance of 14 to 18 billion dollars.

New chief executive Murray Auchincloss describes 2023 as a “year of strong operational performance with real momentum in delivery right across the business”, and says BP will continue to become a “simpler, more focused and higher value company”.