The nuts and bolts of fuel retailing have remained constant for a century or so – drivers still stick nozzles into filler necks, after all – but almost every other aspect of forecourt life has changed since the advent of the motor car. Here, we chart some of the sector developments to have emerged and evolved over the last 12 months.

1. EV charging continues to polarise

2. Developments in valeting show no signs of slowing

3. Security solutions get smarter

5. Parcel lockers take over the world

1. EV charging continues to polarise

The rise of the electric car is intrinsically linked to the filling station, but given the expense involved in installing chargers and the relatively limited number of drivers needing them at present, many operators have been reluctant to install sockets on site.

But while some continue to weigh up the options, others are adamant this is the moment to invest in charging.

EG On The Move’s commercial director, Ilyas Munshi, said just that this year, telling a conference in November: “We feel the time is now for a lot of retailers to start considering EV as an option.”

While Munshi recognised that location plays a big part in deciding whether to install chargers, drivers looking to fill their time while their cars charge represent a new business opportunity, particularly when taken in conjunction with the every-growing popularity of coffee, and food-to-go.

That sense of futureproofing was underlined by chargepoint firm Fastned, which this year shared than grid connections can take four years or more to organise, while, in some areas, connections are simply not possible for the foreseeable future due to limited electrical capacity.

Some firms have taken an overtly bullish position, with MFG’s “aggressive” chargepoint rollout continuing apace in 2025, and the company installing its 1,000th EV bay back in July.

Fellow Top 50 Indie Grove Retail, meanwhile, was recently granted planning permission to bring a derelict petrol station back to life but with no petrol pumps, instead choosing to build a standalone charging hub, just as BP did earlier in the year when it re-opened a west London forecourt offering volts and watts instead of unleaded and diesel.

And yet, with chargepoints often costing hundreds of thousands of pounds to install once grid connections, equipment and groundworks are factored in, many operators have quietly told us they’re quite happy to sit tight for now, with the land chargers could sit on bringing in far greater returns when used as parking bays for shop customers – something that’s more than understandable given this year also saw the Department for Transport publish a study revealing that as things stand, 90% of EV drivers can charge at home.

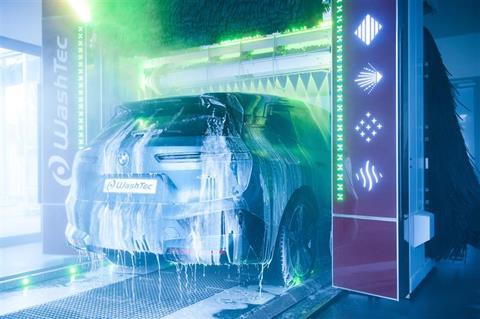

2. Developments in valeting show no signs of slowing

While EV charging might bring consistent profits at some point in the future, for operators looking to maximise the returns each square foot of their land can offer, valeting represents a far safer bet for now.

That was precisely the thinking that Frasers deployed when investing in its busy Brize Norton forecourt, with the family firm telling us in June that the site’s two rollovers and six jet-wash bays represented a better bet for them than charging bays.

Another noteworthy valeting development saw Swiss firm Preen join the Car Wash Association as it looks to roll out its AI-powered car wash that sees robotic arms directly target vehicles with an automatic, but touchless wash.

And while jet wash bays are still very much en vogue, rollover washes, which looked for a while like they were falling out of favour, staged a resurgence. Top 50 indie Highway Stops reported a 40% growth in customers of its automatic washes against a 30% upswing for jet washes, while Sharma Garages invested around £255,000 in an extra large ‘Big Bertha’ automatic machine from Christ Wash.

WashTec’s high-tech SmartCare rollover brought internet connectivity for improved monitoring, plus sleek LED lighting for additional kerbside appeal, while Tom Highland was the first UK operator to take on Adriatech’s Alta Pro rollover machine. Maxol Group, meanwhile, announced it would be introducing a monthly subscription valeting option as well as US-style ‘conveyor’ car washes, while Asda signed a shared revenue agreement with Air Serv to install the first 25 of its 100 new valeting offerings.

Other significant developments include Jos Richardson & Son both drilling their own borehole for valeting water, and investing £150,000 in new rollover and jet wash kit; Johnny Srikrishna putting £300k as he seeks to create the “el dorado” of valeting hubs; and Shell dealer Mehul Rajan spending £200k on a pair of jet-wash bays featuring wash programmes and signage designed to appeal to a younger customer base.

3. Security solutions get smarter

It’s a generally accepted adage that the sophistication of computers doubles every two years and, with crime a continual issue for retailers, it stands to reason that the market for security solutions is one that where the skills of software and hardware engineers are in harmony with retailers’ needs.

Forecourt firms have seen this bear out in a number of areas: newcomer NexPlate made waves this summer with a low-cost anti-drive-off system that deploys sophisticated software that enables a CCTV camera to also act as a plate-reading ANPR one, while Facewatch’s facial-recognition system continued to find both uptake among retailers, and acceptance from members of the public.

Big Brother, meanwhile, rolled out a new software integration between its system and Epos provider Madic, while both BOSS and Vars Technology gained accreditation to electronically request driver details from the DVLA, rather than having to make time-consuming and outdated paper-based applications.

A number of retailers rolled out an age-estimation system that scans shoppers’ faces before granting or denying them access to fridges and beer caves selling alcohol, while pay-at-pump systems continued to find uptake among operators looking to extend their opening hours.

4. Food to go keeps on moving

Several factors are behind the emergence of the filling station as a place for food as much as fuel. But regardless of whether the growth in the UK’s population, increasing numbers of cars, or how difficult driving and parking in town centres has become, one thing’s for sure: the high street’s loss is the forecourt trader’s gain.

With margins on food-to-go strong and technology bringing all manner of new heating, cooling, vending and logistics capabilities, there’s a book to be written about the sector’s move away from the soggy service-station sandwich, and the rise of all manner of tempting treats, snacks and meals that can today be found at your average forecourt.

Average is perhaps a misnomer, though, because there’s so much variety, entrepreneurialism and innovation in the F2G category that it’s difficult to know where to begin.

One of the more significant developments to have emerged this year was Park Garage Group’s Bakery 79 concept, rolled out at over a dozen sites as the firm looks to move away from its reliance on Greggs concessions.

EG On The Move – renowned for its hit rate with F2G offerings – was clearly thinking along similar lines to Park, developing its own Bill’s Bakery concept to replace with Delice de France offerings at four trial sites.

Then there’s Gill Marsh Forecourts, which both began to offer heated Praveen Kumar Indian ready-meals, and also installed a commercial kitchen in one of its sites, enabling it to trial a food delivery service selling gyros, burgers, curries and more.

Another independent operator – top 50 newcomer VST forecourts – had a similar idea after it acquired a site with a commercial catering facility, while Tankerford, which counts a dozen or so forecourts in its portfolio, made use of a similar setup at an East London filling station as it developed its own-label range of food to go.

Speaking of independents, freelance food and retail consultant Matt Cundrick continued to drive innovation in the forecourt sector, launching a smartphone app that uses AI to help retailers optimise their food and drinks displays.

5. Parcel lockers take over the world

Okay, perhaps taking over the world is a bit strong, but given how little space they take up, how many additional customers they bring onto site, and the fact that they represent a small but steady revenue stream, and it’s little wonder that more and more forecourt operators are asking themselves: ‘Why doesn’t my site have a parcel locker?’

So competitive and successful is the sector that the only issue might be choosing which locker to host. With Yeep rolling out 700 solar-powered lockers, Shell opting for Parcel Pending by Quadient units, MFG looking to install almost 400 more Yeep, and 500 Royal Mail lockers, operators with big sites often cover as many bases as possible, teaming up with multiple providers to offer customers a comprehensive suite of locker options.

So rich is this seam that industry leader InPost was able to buy delivery company Yodel for £106, creating the UK’s third-largest logistics firm in the process. Given InPost’s research indicates almost half the UK population planned to use a parcel locker this Christmas, it’s clear that despite barely existing a decade ago, parcel lockers have now very much arrived.