- New car market up 28.3% in July to record full year of non-stop growth.

- Overall year-to-date market remains behind pre-pandemic levels.

- SMMT estimates one battery electric car registered every 60 seconds as deliveries surge 87.9%.

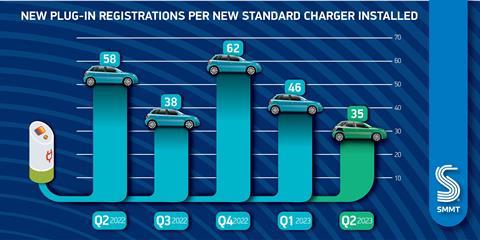

- New market outlook expects one new BEV registered every 50 seconds by year end, rising to one every 40 in 2024, as industry calls for chargepoint mandate to accelerate uptake.

Consumers are set to phase out sales of petrol and diesel cars before the UK government’s deadline of 2030, after which sales of only hybrid or fully electric cars will be permitted, claims Electric Car Count, a monthly data series from New AutoMotive, a not-for-profit independent transport research organisation with a mission to accelerate and support the UK’s transition to electric vehicles.

It forecasts that, on current trends, consumers will effectively end the sale of petrol and diesel cars in 2028-29.

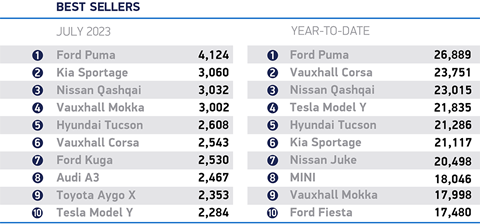

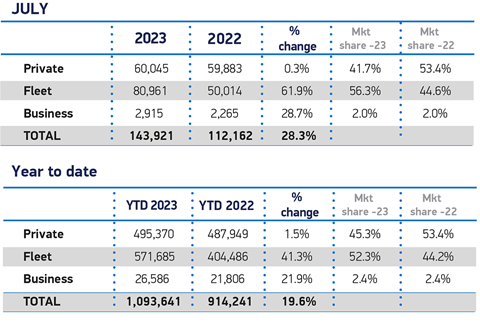

Its comments follow the latest new car sales figures released by the Society of Manufacturers and Traders (SMMT) which recorded 143,921 new vehicles registered in July to record a full year of non-stop growth, and the best performance since July 2020. However, the overall year-to-date market remains behind pre-pandemic levels.

Company registrations drove the growth, as uptake by large fleets increased 61.9% to 80,961 units and business registrations rose 28.7% to 2,915 new vehicles. Private demand remained stable at 60,045 units (up 0.3%).

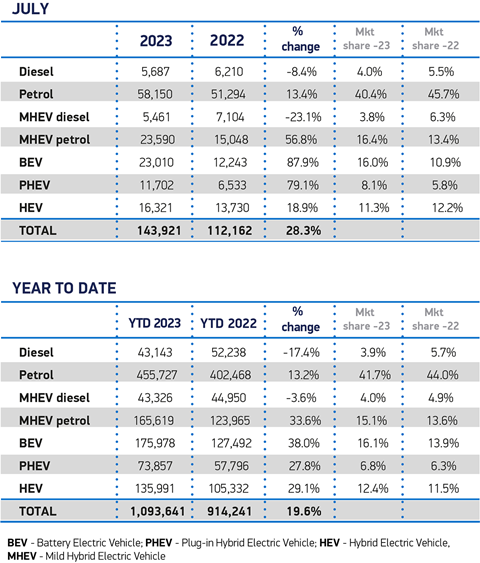

The SMMT reported that electrified vehicles accounted for more than a third (35.4% of the market). Hybrid (HEV) volumes grew, although their overall market share fell to 11.3%. Plug-in hybrid (PHEV) registrations saw a significant uplift for the second month in a row as uptake rose 79.1% to account for 8.1% of the market. The biggest increase, however, was for battery electric vehicles (BEVs), which recorded an 87.9% increase to account for 16.0% of all new registrations for the month.

A standout statistic, according to the SMMT, was that demand for battery electric cars was such that a new one was registered every 60 seconds in the month, and according to the latest market outlook, this will accelerate to one every 50 seconds by the end of the year, and up to one every 40 seconds by the end of 2024.

Forecasts by the SMMT estimate that overall new car registrations will reach 1.847 million by the end of the year, a 0.9% rise on expectations in April. Of these, BEVs are expected to take a 17.8% market share or 330,000 units, a slight decrease on April’s outlook, while PHEVs are set to achieve 7.2% of the market with 134,000 units.

New AutoMotive calculates that petrol car registrations shed 8% of market share in July as electric car registrations grew by 90%, which continues a long-term decline in sales of of petrol-engined vehicles since 2019, when they accounted for 65% of all new cars. Registrations of diesel cars have collapsed from their peak of 50% in 2016.

Competitive leasing deals on electric cars are likely to have driven the 90% jump in electric car registrations in July.

Ben Nelmes, chief executive of New AutoMotive, said:“Debate about the government’s 2030 target is starting to look academic. Consumers have all but ended the sale of diesel cars already, and are increasingly shunning petrol cars.

“Remarkably, despite a recovery in the car market, sales of petrol cars remain in a long term decline, and are still around half of their pre-pandemic peak. Consumers are voting with their wallets and showing that they prefer to go electric.

“The biggest thing preventing more people getting in an electric car remains the supply of vehicles - ministers can fix this by introducing an ambitious ZEV mandate that starts in 2024.”

Ciara Cook, Policy Officer at New AutoMotive, said on the Electric Van Count: “Despite pessimism in the press, businesses are still being won over by the running cost savings e-vans bring during a time of increased costs.

“The government must resist calls to weaken the ZEV mandate, which is already looking much too unambitious. Without increasing targets the government will hurt manufacturers which have excelled in this area, such as British-made Vauxhall.”

Melanie Shufflebotham, COO of Zapmap, said: “The latest figures are clear evidence that electric vehicles continue to grow in popularity, with drivers keen to play their part in the transition to a greener future.

“We support the SMMT’s call for the Government to make it easier for people to buy, run and charge EVs, and we hope people will be encouraged by the continuing growth in infrastructure.

“At the of July 2023 there were more than 45,700 charging points across the UK, across more than 26,800 locations - that’s a significant 40 per cent increase since the same time last year - and the number of ultra-rapid devices for en-route charging has increased by 90%.”

Figures were also released by the SMMT for UK light commercial vehicles (LCV) which shows the number registered in the UK grew for the seventh consecutive month in July, increasing by 44.2% to 26,990 units.

The largest volume growth was recorded for medium-sized vans weighing greater than 2.0 to 2.5 tonnes, which more than trebled, up 227.4% in the month. Registrations of the largest LCVs, weighing greater than 2.5 to 3.5 tonnes, increased by 29.3% to 19,111 units and accounted for 70.8% of the market registered in the month. Deliveries of 4x4s and pickups also saw growth, up 159.3% and 48.3% respectively, while registrations of vans weighing up to and including 2.0 tonnes were the only segment to decline, falling -40.9% to 427 units.

Demand for zero emission work horses continued to grow with battery electric vans (BEVs) soaring 94.6% to 1,489 units and a 5.5% market share – up from 4.1% last year; 10,292 BEVs have been registered so far in 2023, an increase of 16.1% year on year, although market share has decreased marginally from 5.4% to 5.2% in the year to date.