Close menu

- Home

- News

- Reports

- Fuel

- Retail

-

Shop

- Back to parent navigation item

- Shop

- Shop Suppliers

- Alcohol

- Batteries

- Breakfast

- Car Care & Lubricants

- Chilled & fresh

- Confectionery

- Food to go

- Health & Beauty

- Hot Beverages

- Ice cream & frozen

- Mint & Gum

- Sandwiches & Snacks

- Seasonal

- Soft drinks

- Tobacco & Vaping

- Focus On Features

- A to Z of all Subjects

- Equipment

- Events

- Vision

- Newsletters

Global IT outage reinforces value of cash to forecourt trade

By Juliet Morrison2024-07-31T08:58:00

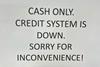

This month’s global IT outage, which disrupted electronic payment systems and led to queues at ATMs and ‘cash only’ signs being brought out of storage by forecourt operators, highlighted the perils of moving to a cashless society.

Already registered? Please log-in here

To continue reading, register for free today

With free guest access you can:

- Read unlimited articles

- Access the Fuel Market Review

- Read the latest Top 50 Indies report

- Sign-up for our newsletter

- Related Websites:

- Forecourt Trader Awards

- Grocery Retail News

- Convenience Store

- Industry Links:

- Petrol Retailers' Association

- Fuels Industry UK

- Lumina

Site powered by Webvision Cloud