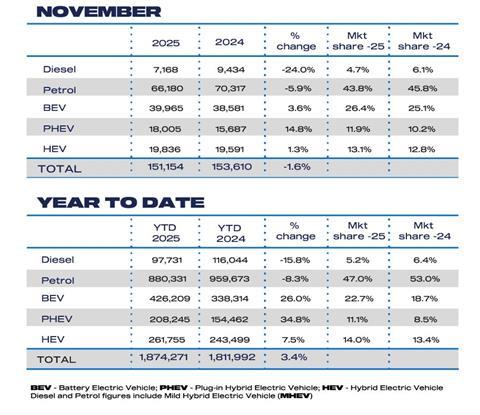

The battle to ensure new-car shoppers buy the correct proportion of battery- powered models looks set to be lost in 2025, with EV sales for the first 11 months of the year standing at 22.7%, against a government target of 28%.

A total 426,209 new EVs have changed hands so far this year, less than half the number of petrol models, while motorists also prefer hybrids, buying precisely 470,000 petrol/diesel/electric cars.

November brought about a slight dip in registrations, with the Society for Motor Manufacturers and Traders, which compiled the data, attributing the 1.6% drop to “Budget drag”, as motorists waited to hear what the Chancellor would have in store for them in her 26 November statement.

That statement brought with it confirmation that a new pay-per-mile road charge will be introduced for electric and plug-in hybrid cars in 2028, and all eyes will be on December’s figures to see if potential battery-car customers will view the forthcoming 3p per mile cost as more reason to choose some other powertrain type.

November’s 1.6% drop in sales was driven by private buyers shying away from showrooms, as while fleet and business registrations rose last month, retail purchases were down 5.5%.

While ‘credit swaps’ and other market mechanisms are set to excuse manufacturers from government fines of £15,000 per non-EV they sell over quota, with registrations so far off the 28% target for the year, 2026’s requirement for 33% of all new registrations go to electric cars looks even more unattainable.

Robert Forrester, chief executive of car dealership chain Vertu, last month warned the UK’s EV targets are “completely unrealistic”, and predicted manufacturers may introduce “rationing of petrol and diesel cars” to reduce the amount they miss their EV marks by next year.

The SMMT’s chief executive, Mike Hawes, described November’s registration figures as representing “the weakest growth for almost two years”, and said they should stand as “a wake-up call that sustained increase in demand for EVs cannot be taken for granted”.