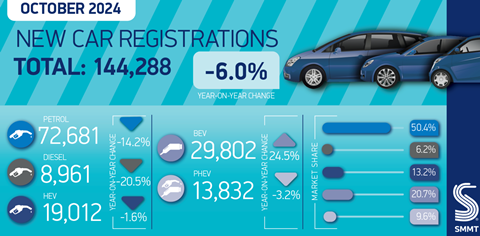

The UK new car market fell for the second time this year, down by -6% in October to 144,288 new registrations, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

The SMMT says the fall was driven by double-digit drops in petrol and diesel vehicle deliveries, down -14.2% and -20.5% respectively. And uptake of hybrid EVs and plug-in hybrid EVs also fell, down -1.6% and -3.2%. Battery EVs (BEVs) were the only powertrain to record growth, with new models driving the strongest growth this year, up 24.5% to reach a 20.7% share of the market.

October’s decline in the total market, equivalent to a £350m loss in turnover, highlights the challenge ahead, says the SMMT. While almost 300,000 new BEVs have reached the road in 2024, this represents 18.1% of the market – an increase on 2023, but still significantly short of the 22% target for this year and the 28% target which must be achieved in 2025 under the Vehicle Emissions Trading Scheme.

Mike Hawes, SMMT chief executive, says that manufacturers are currently shoring up demand with historic levels of support, but this is unsustainable in the long term as it threatens viability. “Massive manufacturer investment in model choice and market support is helping make the UK the second largest EV market in Europe. That transition, however, must not perversely slow down the reduction of carbon emissions from road transport. Fleet renewal across the market remains the quickest way to decarbonise, so diminishing overall uptake is not good news for the economy, for investment or for the environment. EVs already work for many people and businesses, but to shift the entire market at the pace demanded requires significant intervention on incentives, infrastructure and regulation.”

UK new car buyers now have more than 125 different BEV models to choose from – an uplift of 38% over the last 10 months. Hawes says that while it remains the case that the average BEV has a higher upfront cost than an ICE equivalent, widening choice and huge manufacturer discounting mean that around one in five BEV models now has a lower purchase price than the average petrol or diesel car, especially for buyers able to take advantage of schemes such as salary sacrifice.

“Without the government support to match the manufacturers’ commitment, there must be an urgent review of the market’s performance and the regulatory mechanisms driving the transition,” says Hawes.