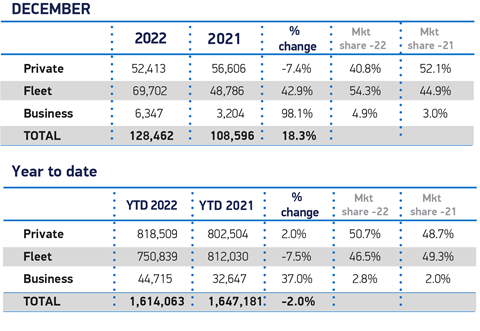

The UK new car market recorded its fifth consecutive month of growth in December, with an 18.3% increase to reach 128,462 new registrations, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

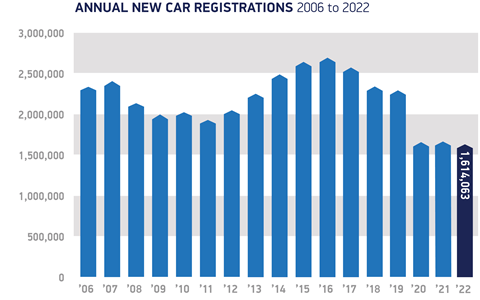

This second half year performance was not enough, however, to offset the declines recorded during the first half of 2022. Despite underlying demand, pandemic-related global parts shortages saw overall registrations for the year fall by 2.0% to 1.61 million, around 700,000 units below pre-Covid levels.

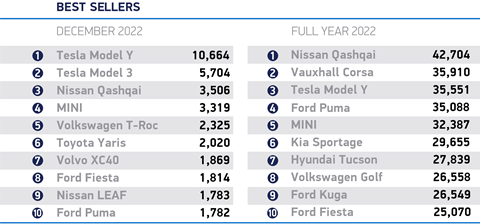

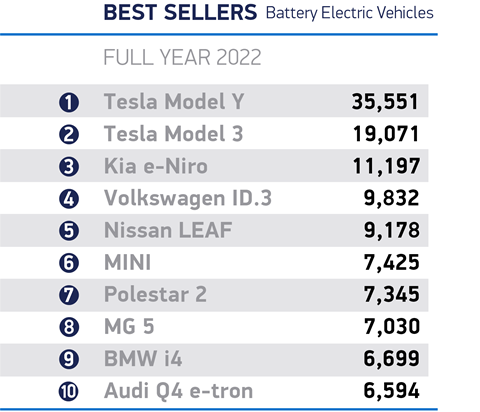

Constrained supply saw many manufacturers prioritise deliveries of the latest zero emission-capable models. December saw battery electric vehicles (BEVs) claim their largest ever monthly market share, of 32.9%, while for 2022 as a whole they comprised 16.6% of registrations, surpassing diesel for the first time to become the second most popular powertrain after petrol. Meanwhile, plug-in hybrids (PHEVs) saw their annual share decline to 6.3%, meaning that combined, all plug-in vehicles accounted for 22.9% of new registrations in 2022 – a record high, although a smaller increase in overall market share than recorded in previous years. Hybrid electric vehicles (HEVs) also enjoyed growth, rising to an 11.6% market share for the year. As a result, average new car CO2 fell -6.9% to 111.4g/km, yet again the lowest in history.

Charge-point provision remains a barrier to EV uptake, however. The government’s EV Infrastructure Strategy forecasts that the UK would require between 300,000 and 720,000 charge-points by 2030, and even meeting the lower of the two figures would still require more than 100 new chargers to be installed every single day; which is significantly higher than the current rate of around 23 per day.

Manufacturers face a Zero Emission Vehicle Mandate from 2024, the details of which have still not been published. As a result, accelerated investment in charging infrastructure is needed if consumers are to be confident they can make the switch and brands are to have a chance of securing sufficient supply to support UK market growth and not lose out to other markets which are investing more rapidly. Last year, Britain reclaimed its position as Europe’s second largest new car market by volume, both overall and, specifically for plug-in cars. However, as of the end of Q3 2022, it was 13th overall by plug-in market share, behind markets including Norway (78.3%), the Netherlands (28.7%) and Germany (23.5%).

Mike Hawes, SMMT chief executive, said: “The automotive market remains adrift of its pre-pandemic performance but could well buck wider economic trends by delivering significant growth in 2023. To secure that growth – which is increasingly zero emission growth – government must help all drivers go electric and compel others to invest more rapidly in nationwide charging infrastructure. Manufacturers’ innovation and commitment have helped EVs become the second most popular car type. However, for a nation aiming for electric mobility leadership, that must be matched with policies and investment that remove consumer uncertainty over switching, not least over where drivers can charge their vehicles.”

Looking ahead, supply chains are beginning to stabilise and although the shortage of semiconductors is expected to ease, erratic supply will likely impact manufacturing throughout 2023. The most recent market outlook, published in October 2022, anticipates around 1.8 million new car registrations in 2023, worth around £8.4 billion in additional turnover.

Industry reaction

As you might expect, today’s news has been met with a wide range of reaction across the industry; and below is our round-up of the most noteworthy responses thus far.

Fiona Howarth, CEO of Octopus Electric Vehicles, said: “It’s no surprise to see EVs take a greater overall market share in 2022. We’re seeing plenty of pent up demand, with large order books and thousands of drivers waiting on their cars to be delivered as manufacturers try to bolster supply chains. EV popularity continues to grow month-on-month as more people understand the benefits of making the switch. The average driver can save well over £1,000 a year on fuel costs compared to an old school gas guzzling car, while being able to charge at home provides many with greater convenience - making charging your car as easy as your phone. There’s no doubt that 2023 will be another landmark year for the industry as we accelerate towards net zero transport.”

Ben Nelmes, CEO of NewAutomotive, an independent transport research organisation, added: “December’s figures are seriously impressive. This is the result of years of government support through consumer and fiscal incentives, as well as a clear long-term ambition to end sales of fossil-fuelled cars by 2035.

“As the government winds up grants and incentives for electric cars, it needs to be careful that these impressive numbers are not just a flash in the pan. Electric car registrations can go down as well as up. Ministers should enshrine their 2035 ambition in law by introducing a California-style Zero Emissions Vehicle (ZEV) mandate, which provides the market with clarity about the UK’s journey to cleaner road transport.”

“Delays to the UK’s plans to introduce a zero-emissions vehicle mandate risk undermining the case for investment in gigafactories and charging infrastructure. A strong ZEV mandate will bring forward running cost savings for consumers that dwarf debates about fuel duty rates. Consumers have shown that they are ready to pass on petrol and embrace electric; now is the time for the government to show that it is on their side by setting ambitious targets that enable more people to access the benefits of going electric.”

Jon Lawes, Managing Director of Novuna Vehicle Solutions, is cautious with regards to infrastructure challenges. He noted: “Last year ended with a better-than-expected increase in EV ownership, with the number of EV registrations reaching a record market share of 32.9%, ending the year as the second most popular powertrain after petrol. We expect this positive trajectory to continue into the new year, despite supply issues continuing to hamper the industry’s ability to meet demand.

“However, as we enter 2023, the road to net zero remains bumpy, with EV infrastructure failing to keep pace with adoption. Our analysis shows that to hit Government targets, 30,000 new charging points will need to be built every single year for the next seven years, a tenfold increase in the number put in the ground in the past decade. Addressing the fragility of the current charging network, at scale and ahead of need, is critical to support mass adoption of EVs which requires urgent collaboration and investment from across the sector in the year ahead.”

Finally, Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), said: “2022 was an irregular year for new car registrations with the market impacted by wide ranging factors from supply constraints, driven by continued lockdowns and the war in Ukraine, to the cost-of-living crisis impacting demand in the UK. Looking ahead, NFDA and its members remain cautiously optimistic. Franchised dealers are well placed to enable the UK’s transition to electric vehicles through schemes such as Electric Vehicle Approved (EVA), which are in place to ensure consumers receive the correct support in their switch to electric.”

No comments yet