Firms looking to buy petrol stations are frequently getting loans with repayment terms that stretch well beyond 2035 – the date by which sales of new petrol and diesel cars are set to be banned. This reverses the previous status quo, which saw financiers require loans and mortgages issued against petrol stations to be repaid by 2035, and indicates banks have acquired a renewed confidence in the sector.

The insight comes from commercial finance company Christie Finance, whose associate director for finance, Ashley Clements, says “we are seeing positive movements in the funding space in this sector”.

Clements details that lenders had previously been “pessimistic” about the long-term future for filling stations, and as a result required loans and commercial mortgages issued against them to be repaid by 2035.

This restriction presented operators looking to grow or begin their businesses with “affordability challenges” due to tight repayment schedules. Things have markedly improved of late, Clements says, and Christie Finance is “now seeing lots of lenders change their policies”. Loan-to-value rates for petrol stations have also increased, with 70% LTV ratios available for “the right site and operator”.

Clements describes the previous lending cap of 2035 as “a very strange policy”, since while sales of new petrol and diesel cars are banned from that date, the cars themselves can be used in perpetuity. The consensus is that a robust number of cars with internal combustion engines will be on the road “for at least 20-30 years”, he adds.

The removal of the previously prevalent 2035 restriction for forecourt finance “reduces debt servicing costs”, Clements says. Longer repayment terms both allow for lower instalments, and are typically associated with reduced interest rates.

Firms in the sector should be aware that “nearly every lender” is required to understand the environmental impact of a filling station that is being lent against, though, meaning an ecological survey must typically be prepared in advance of finance applications.

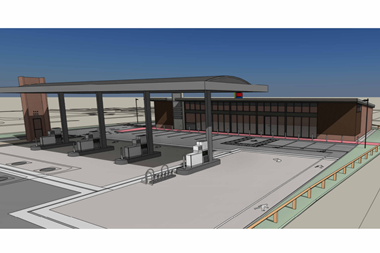

This echoes local authority rules, with councils often requiring carbon-reduction or offsetting measures to be included in planning applications. EV charging, solar panels, heat pumps, low-energy lighting and high-tech insulation are common features in design and access statements as a result.

Advertising firms and car makers sing from similar hymn sheet

It’s not just banks that have become alive to the possibility that the demise of petrol and diesel may have been exaggerated. Just this week the Financial Times found that the ‘Big Six’ global advertising and PR firms are “re-embracing fossil fuel clients”.

The FT reports that US company Interpublic “reworded policies” to work on brand campaigns for oil majors, while contracts between fossil-fuel firms and advertising and PR agencies have risen in the past year as creative companies grapple with competition from AI.

Auto makers, meanwhile, have become increasingly vocal over their concerns that electric-vehicle mandates are unworkable in the face of consumer reluctance to switch to battery power. The chief executive of Mercedes last month co-signed an unprecedented letter to the head of the European Commission warning that the EU’s electrification plans are “no longer feasible”.