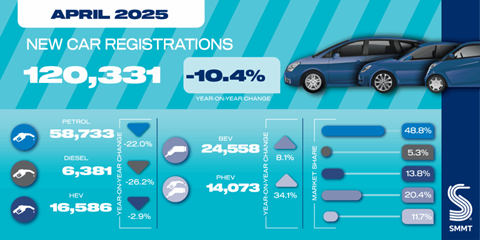

Hybrid cars comfortably outsold EVs last month, as the new-car market declined 10.4% overall. Hybrids made up 25.5% of sales, with EVs being chosen by 20.4% of buyers.

With conventional hybrids making up 13.8% of the market, and plug-in hybrids taking 11.7% of sales, cars running on both petrol and battery power took more than one in four registrations in April.

Some 20.4% of buyers choose an electric car last month, up from 16.9% in April 2024. Hybrids also gained in popularity, with conventional hybrids up from 12.7% to 13.8% of the market, and plug-ins increasing from 7.8% to 11.7%.

In terms of total sales, EVs rose 8.1%, from 22,717 to 24,558. Conventional hybrid sales actually fell by 2.9% (from 17,081 to 16,586); plug-in hybrid registrations were up a significant 34.1%, from 10,493 to 14,073.

The data comes from the Society of Motor Manufacturers and Traders, which classifies conventional hybrids and plug-ins as separate fuel classes, so counted EVs as “the second most popular powertrain after petrol”. If vehicles running on a combination of petrol and electricity are counted together, though, these cars are significantly more popular.

Petrol cars (including ‘mild’ hybrids - those with beefy stop-start systems) remain the most favoured overall, making up 48.8% of the market, though this was down on April 2024, when 56.1% of new cars ran on the petrol.

Diesel sales continues to decrease. Favourable road tax rates once saw new diesel cars hold almost 50% of the market, that figure decimated to 5.3% last month (including ‘mild’ hybrid diesels), and down from 6.4% in April 2024.

Total sales for April 2025 were down around 10,000 cars compared to April 2024, with fleet buyers making up 59.4% of the market, and retail customers buying 38.6% of cars, a proportion that was broadly unchanged over last year.

The SMMT warned that the ZEV Mandate, which this year requires 28% of new cars to be electric before rising to 33% in 2026, remained “incredibly challenging”, calling for more to be done to “stimulate demand”.

April is traditionally a quiet month for new-car sales due to it following the new March number-plate, but last month was particularly subdued due to a change to road tax introduced at the start of the month, which fleet and private customers alike sought to avoid by buying new vehicles in March.

From April 1 2025, EVs were no longer exempt from the ‘expensive car supplement’, which sees vehicles with a list price of £40,000 or more subject to an additional £425 a year or road tax from years two to six of a vehicle’s life, adding £2,125 to a car’s cost over this period.

The SMMT’s chief executive, Mike Hawes, calls April’s registration figures “disappointing but expected”, and added that “EV uptake is still being heavily and unsustainably subsidised by the industry”. Hawes says “a compelling package of measures from government” was “essential” if drivers are to buy enough electric cars.