High margins and lack of competition among forecourts mean motorists are paying too much for fuel, despite prices falling since summer, according to the UK’s markets watchdog.

In its fourth three-monthly interim report since launching the series last year, the Competition and Markets Authority also says the introduction of real-time fuel price tracking in 2025 will help drive down prices.

The CMA says margins – the difference between what a retailer pays for its fuel and what it sells at – remain at the “high levels” seen when it published its road fuel market study last year.

Non-supermarket forecourts increased their margins from 7.8% in April to 10.2% in August, concludes the CMA, with supermarkets raising margins from 7% to 8.1% over the same period.

“The sustained increase in the level of fuel margins is concerning and suggests that overall levels of competition in the road fuel retail market remain weakened,” says the report.

The CMA acknowledges that fuel prices fell for both petrol and diesel from June to October 2024, which it says reflects, in part, changing crude oil prices.

The average petrol and diesel prices at the end of October were 134.4 and 139.7 pence per litre (ppl) respectively. This represents a decrease of 10.0 ppl and 10.4 ppl in petrol and diesel prices over the previous four months.

“While fuel prices have fallen since July, drivers are paying more for fuel than they should be as they continue to be squeezed by stubbornly high fuel margins,” says Dan Turnbull, CMA director of markets. “We remain concerned about weak competition in the sector and the impact on pump prices.”

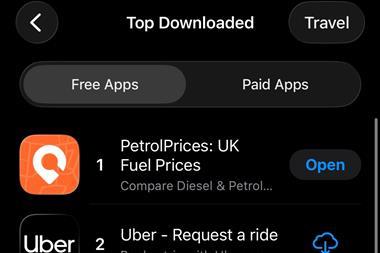

He says measures to compel retailers to report changes in retail prices instantly will “empower drivers to find the cheapest fuel prices, wherever they are in the UK, increase competition and support the economy – the more people save on fuel, the more they will have to spend in other areas.”

The CMA’s road fuel market study, published in July 2023, found that competition in the sector had weakened since 2019. In response it recommended that the government introduce a statutory “open data fuel finder” and create a monitoring function to “hold the industry to account”.

The then Conservative government accepted the findings and introduced a voluntary price data-sharing initiative in August last year. The current government intends to bring the mandatory scheme into force next year as part of the Digital Markets, Competition and Consumers Act 2024.

The CMA has been basing its findings on information supplied voluntarily by retailers and petrol companies including Applegreen-Petrogas, Asda, BP, Esso, Euro Garages, Morrisons, Moto Hospitality, Motor Fuel Group, Rontec, Sainsbury’s, Shell, Tesco, and Welcome Break.

Responding to the CMA’s observations on developments in the road fuel retail market since the previous update in July 2024, Gordon Balmer executive director of the Petrol Retailers Association says.

“Petrol retailers continue to price fuel as low as possible in a highly competitive market while grappling with rising costs in the form of business rates, National Insurance, the national minimum wage and electricity. The CMA has acknowledged these increased costs as a factor and it is crucial these are incorporated into future analysis to give a complete picture.”

He adds: “We have supported the CMA throughout their investigation and will continue to do so by providing information and evidence that clearly outlines how the surge in fixed costs is impacting pump prices and the steps needed to address it. I look forward to seeing the CMA incorporate these statistics into their next report.”