The absence of government incentives for private buyers is having a marked effect on the uptake of EVs, according to SMMT chief executive Mike Hawes.

His views were echoed by Ian Plummer, commercial director of Auto Trader, who said we need to see “even more price action to achieve mass electric adoption”.

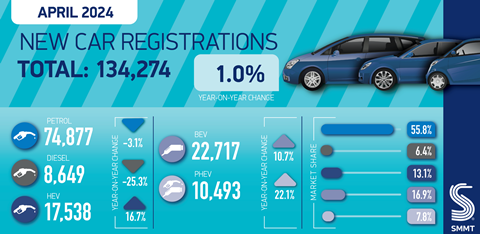

The comments come as the SMMT (Society of Motor Manufacturers and Traders) released its latest data, which showed that UK new car registrations grew for the 21st consecutive month in April, rising by a modest 1% to reach 134,274 units. As a result, this was the market’s best April since 2021, although uptake was still -16.6% below the pre-pandemic level in what is traditionally a low volume month following the March plate change.

Once again, growth was driven entirely by fleets, where registrations rose by 18.5% to reach 81,207 units – more than six in 10 of all new cars registered in April. Private buyer uptake fell by -17.7% to 50,458 units, while business registrations declined by -16.1%, to 2,609.

Electrified vehicles continued to be the main drivers of market expansion. Plug-in hybrids (PHEVs) recorded the strongest growth, rising by 22.1% to account for 7.8% of the market, followed by hybrid EVs (HEVs), up 16.7% with a 13.1% share of demand. April was a brighter month for battery EV (BEV) registrations, predominantly due to fiscal incentives for businesses. Overall, BEV uptake rose 10.7%, pushing up market share to 16.9%, a significant uplift on last April’s 15.4%.

Petrol car sales were down by 3.1% but they still command 55.8% of the market. Diesel car sales were down 25%, giving them just 6.4% of the market.

Hawes said that while the overall increase in BEV demand is positive, urgent action is needed to re-enthuse private buyers into switching. Fewer than one in six new BEVs bought in April went to consumers, whose uptake volumes fell by -21.9%.

“Drivers today enjoy the widest ever choice of BEV models – more than 100 – powered by the latest technology, and manufacturers continue to provide compelling offers to encourage their uptake. However, the lack of government incentives for private motorists remains a barrier that cannot be overcome by industry alone.”

Hawes said that tax incentives are proven to deliver a rapid shift to BEVs in the fleet market, so providing private buyers with a similar level of support would accelerate an overall market shift, fuel economic growth and deliver a sustainable, fair transition. “Temporarily halving VAT on new BEV purchases would help more than a quarter of a million drivers to switch from fossil fuel to electric over the next three years. Similarly, altering the threshold for the ‘expensive car’ supplement to Vehicle Excise Duty – due to apply to EVs from April 2025 – would send the message to the market that zero emission vehicles are necessities, not luxuries.”

He added that action is also needed on infrastructure, with nationwide chargepoint installation essential for consumer confidence.

Meanwhile, Auto Trader’s Ian Plummer, commented: “With new car prices up 29% on average since 2020, there’s a risk that many consumers will be priced out of the market, which we can see playing out in April’s flat retail registrations. Even though EVs are only up 7% in that period they are typically 35% dearer than traditionally fuelled petrol and diesel models.

“The discounts we’ve seen manufacturers offer to incentivise consumers into new electric cars seem to be working, with BEV registrations up on 2023. That said, we’ll need to see even more price action to achieve mass electric adoption.”

He added that BYD’s Seal car was among the most viewed EVs on Auto Trader in April, showing the growing influence of new entrants.